Accounting info. VAT recovery 1s bp 3.0 VAT recovery when written off

Shown in this illustration:

In the first case, the VAT previously paid to the budget is “restored”, i.e. The VAT amount is returned to us.

In the second case, we must pay the tax previously claimed for reimbursement.

In both cases the same term is used, but in practice it has two directly opposite meanings.

This is especially clearly seen when analyzing VAT on advances received and paid.

When we receive an advance from a buyer, an obligation arises to pay VAT on this amount. After selling the goods, we are also required to pay VAT. In order not to pay the same tax twice, we can submit the first payment for reimbursement, i.e. "restore".

A similar situation, but with the opposite sign, occurs when we pay an advance to the supplier. We have the right to claim VAT on the advance payment for reimbursement, thereby reducing the total amount of tax. But in the future, after receiving the goods, the VAT amount will have to be returned to the budget (so as not to submit the same amount for reimbursement twice).

Both situations are automated in the 1C 8.3 program.

The first option for restoring VAT in 1C

Let's consider the option with an advance payment from the buyer (Fig. 1.).

The 1C program itself determines the amount received as an advance and generates the corresponding transactions (Fig. 2).

The posting to VAT accounts is generated by the advance invoice (Fig. 3). Note that advance invoices can be issued both at the time of receipt of funds to the current account, and at the end of the month.

Upon sale, the advance amount is automatically reversed (Fig. 4)

The sales invoice does not make any postings, but generates movements in other registers that are needed for further work with VAT (Fig. 5).

“Recovery” of VAT occurs in the document “” (Fig. 6)

Get 267 video lessons on 1C for free:

The “Received advances” tab in 1C 8.3 is filled in automatically and contains all the amounts for “restoring” VAT on previously received advances (postings in Fig. 7).

The final picture can be seen in the “ ” and “Purchase Book” reports.

The sales book in 1C (Fig. 8) contains two entries for the Achilles counterparty. One entry is for an advance payment (dated 01/10/2016), the second is for sale (dated 01/26/2016).

The purchase book also contains an entry for this counterparty. It compensates for the advance entry in the sales book. All three entries are for the same amount (RUB 7,627.12).

As a result, you will only have to pay to the budget once.

Let's check that account 76.AB is closed (Fig. 10).

Recovering VAT from supplier advances

Similarly, in 1C 8.3 Accounting, VAT is restored from the advance payment to the supplier.

The document chain will look like this:

- Invoice from supplier for advance payment

- Supplier invoice

Unlike the first option, “VAT restoration” will occur in the document “Creating sales ledger entries” (Fig. 11).

Two entries (for advance payment and for receipt) will be created in the purchase book (Fig. 12).

A “restoring” entry will appear in the sales book (Fig. 13).

VAT on advances to suppliers is accounted for in account 76.VA. The balance on it should also be checked (Fig. 14).

There are a number of other moments when it is necessary to restore VAT. For example, when products intended for sale at a rate of 18% were sold at retail, that is, without VAT. In this case, VAT on materials used in production must be restored, i.e. return to the budget. You will also have to pay VAT if the supplier’s invoice is declared invalid or lost by the tax office. The opposite situations also arise in which the organization has the right to refund previously paid VAT.

In this article we will take a step-by-step look at how VAT is reflected when purchasing any goods, it and checking for the correctness of previously entered data.

The very first document in the chain for reflecting VAT in 1C 8.3 in our case will be.

The organization LLC "Confetprom" acquired 6 different nomenclature items on the basis of "Products". For each of them the VAT rate is 18%. The amount of this tax received is also reflected here.

After the document was processed, movements were formed in two registers: “Accounting and tax accounting”, as well as the accumulation register “VAT presented”. As a result, the amount of VAT for all items amounted to 1306.4 rubles.

After we have processed the document for purchasing goods from the “Products” database, it is necessary. To do this, enter its number and date in the appropriate fields. After this, you need to click on the “Register” button.

All data in the created invoice is filled in automatically. Please note that in our case, the “Reflect VAT deduction on receipt date” flag is selected. Otherwise, taxes will be taken into account when creating purchase ledger entries using a document of the same name.

After posting, our invoice created movements in all necessary registers in the amount of 1306.4 rubles.

Checking the correctness of data

Despite the fact that the program calculates and generates most of the data automatically, errors are possible.

Of course, you can manually check the data in the registers, setting the appropriate selections, but you can also use a special report. It's called "Express Check".

In the form that opens, we will indicate that we need to check the data on the organization of Confetprom LLC for July 2017. You can specify any period, not necessarily within a month.

In the image above, you can see that in some sections the last column is highlighted with a red background. The number of detected errors is also written there.

In our example, we can see that the program found an error in maintaining the value added tax purchase book. When disclosing groupings, we may receive additional information due to errors.

VAT adjustment

When working with 1C Accounting 8.3, there are often cases when you need to change a receipt document “retroactively”. To do this, there will be an adjustment to the receipt, which is created on its basis.

By default, the document is already filled out. Please note that we will recover VAT in the sales ledger. This is indicated by the corresponding flag on the “Main” tab.

Let's go to the "Products" tab and indicate what changes need to be made to the initial receipt. In our case, the number of Assorted sweets purchased changed from four to five kilograms. We entered this data in the second line “after change”, as shown in the image below.

The adjustment of the receipt, just like the initial receipt itself, made movements in two registers, reflecting only the changes made in them.

Due to the fact that a kilogram of Assorted sweets costs 450 rubles, VAT on it amounted to 81 rubles (18%). It is this data that is reflected in the movements of the document.

There are two options for VAT recovery.

Reinstatement of VAT that was paid earlier. In this case, the VAT amount is returned to the account of the payer organization.

Restoration, when the payer organization must pay the tax that the budget has submitted for reimbursement.

Both options have the same term, but the meaning is opposite. You can see the difference by analyzing the VAT on advances when we receive them and when we transfer them. When receiving an advance from a counterparty, obligations arise to pay VAT on the transferred amount. Also, the obligation to pay VAT arises from the sale of goods upon sale. A VAT refund is provided for the received advance payment upon presentation for reimbursement (recovery). When transferring an advance payment to a supplier, it is also possible to recover VAT from the specified amount; on this basis, the total amount of tax is reduced. Subsequently, after receiving the goods, you will need to transfer VAT to the budget (so that the refund does not repeat). We propose to analyze in detail how VAT is restored from the received advance payment, which was transferred by the buyer counterparty.

The program will automatically recognize the received payment as an advance payment and generate the necessary transactions:

Please note that VAT accounting transactions are created by the “Invoice” document. It can be generated either when an advance is received on the account, or through special processing at the end of the accounting period (month).

Let's create an invoice issued based on receipt to the bank account:

Let's check the wiring:

When creating the “Implementation” document, the advance payment should be generated automatically. You can check using the implementation transactions:

The “Invoice” document itself, created upon implementation, does not create any postings, but reflects the movement of VAT in other important accounting registers.

The VAT recovery process is reflected through the document “Creating purchase ledger entries”:

In this case, filling out the “Received Advances” tab in 1C occurs automatically. All amounts for received advance payments that can be submitted for VAT recovery are reflected here:

Checking the wiring:

You can track the results of routine VAT accounting operations by generating the “Sales Book” and “Purchases Book” reports:

If you go to the “Sales Book” report, then for one counterparty-buyer there will be two records reflected for the accounting period (month) for the received advance and the created sales:

If you look at the “Purchases Book” report, the same counterparty will appear here, and the entry for it will compensate for the advance payment in the sales book.

The same amount will be reflected in all entries. It follows from this that payment of VAT to the budget will be one-time. By generating the “Turnover balance sheet” report, you can check the closure of account 76. AB (VAT on advances and prepayments):

With advance payments from suppliers, VAT recovery in the 1C 8.3 program occurs in a similar way. In this case, documents must be generated in the following order:

Debiting from the current account.

Invoice for advance payment received from the supplier.

Purchase Invoice.

Invoice against delivery note.

The only difference from the previous option is that VAT is restored according to the document “Creating sales book entries”.

The document “Purchase Book” will reflect the records of the advance payment and receipt:

And in the “Sales Book” an entry about VAT restoration will be displayed:

VAT on advance payments to suppliers is accounted for in account 76.VA (VAT on advances and prepayments issued), the movement of which can be viewed in the balance sheet:

A few more nuances when VAT can be restored:

When selling products at retail (excluding VAT), intended for sale at a rate of 18%. In this case, it is necessary to restore (return to the budget) the VAT on the material used in production.

If the tax office recognizes the supplier’s “Invoice” document as invalid or lost.

There are also reverse situations when an organization can restore previously paid VAT. For reflection in the 1C program there is a standard document “VAT Restoration”:

This document, in fact, is a corrective document for the purchase book and sales book, depending on the purpose of VAT recovery. For example, the amount of recovered VAT can be written off to the expense account:

In this case, the restored VAT will be reflected in the “Sales Book” document as an entry on an additional sheet.

“VAT in 1C 8 2” is a complex accounting block, and it is also difficult to understand and comprehend. VAT is a federal tax that appears to an enterprise that creates additional market value in transactions related to the sale of goods, work, services (hereinafter referred to as goods). A step-by-step presentation of tax accounting clearly looks like this: “Outgoing VAT” (calculated on sales revenue); “Input VAT” (paid to suppliers); the difference found between “Output VAT” minus “Input VAT” is equal to the amount that legal entities are required to pay to the federal budget of the state treasury.

Accounts involved in VAT accounting

- 68.02;

- 68.32;

- 76 VA;

- 76 AB;

- 76 OT;

- 76 NA.

In the list of accounting accounts, there is an account that, in a standard configuration, is defined for accounting and collecting VAT. Value added tax accounting in 1C is carried out on account 19, which has sub-accounts.

Active-passive account 68.02 in a standard configuration is used to record summary VAT figures and draw up a declaration, which is submitted monthly to regulatory authorities.

The declaration changes frequently, so it is necessary to monitor changes in legal reference systems and apply them in your work.

Account 68.2 subaccount 2 is necessary for accounting for export transactions when it comes to VAT refund from the budget, with the permission of the regulatory authority. Here we need to talk about separate accounting in a typical input tax configuration.

To account for VAT, when companies represent themselves as an agent (tax agent), there is in a standard configuration account 68.32, it reads “VAT when using the duties of a tax agent.”

Received prepayments and advances from buyers (hereinafter referred to as prepayments) are reflected in accounting account 62.02 “Advances from buyers,” and VAT on these transactions in a standard configuration on account 76 AB.

When the company itself transfers advances and prepayments to counterparties, according to the terms of the agreement, in a standard configuration there is an account 76.BA.

In a typical configuration, before you start working, be sure to check the accounting policy settings.

The standard configuration takes into account all the requirements of current legislation in the field of taxation.

How does “s/f issued” work in a typical configuration?

- For shipment;

It is issued when performing transactions related to taxation.

Its registration takes place, subject to the subordination structure, on the basis of sales transactions. Accounting entry, as well as position in when posting the “Realization” document.

D-t 90.03 K-t 68.02

- upon receipt of an advance;

An account is created for the advance payment received from the buyer, the basis is the payment document. When performing the processing “Creating an advance payment account”, you can automatically create an advance payment account when you press the “Fill” button.

If you post a tax accounting entry, a tax accounting entry is indicated, and a VAT line appears in the sales book.

D-t 76 AB K-t 68.02

When shipment is in progress, the previously received prepayment is offset. The regulatory procedure creates a c/f record on the “Deduction of VAT from advances received” tab of the document “Creating purchase ledger entries.”

D-t 68.02 K-t 76 AB

- to increase the cost;

It is completed using the “Adjustment of Implementation” operation.

The following checkbox is placed in the documents:

— In implementation — “Adjustment by agreement of the parties”;

— In s/f – “Adjustment”.

The document “Adjustment of sales” must be carried out, after which invoice positions are displayed for the amount of the adjusted sales value and accrued VAT. Records similar to the primary ones appear:

— D-t 62.01 K-t 90.01;

— D-t 90.03 K-t 68.02.

A line appears in the sales book at the time the accounting for adjustment positions is posted.

- to reduce the cost.

It is drawn up using the “Implementation Adjustment” document.

The sign is given:

— In the implementation document — “Adjustment by agreement of the parties”;

— In the document s/f – “Adjustment”.

As part of the routine procedure for creating a purchase ledger, an adjustment account line appears, and account entries are also created:

D-t 68.02 K-t 19.09

Account 19, subaccount 09, is used to reflect the adjustment amount of VAT associated with a decrease in the cost of sales. Price reductions are prescribed in a bilateral agreement (amendment) to the contract.

The creation of adjustment accounting records is reflected in the purchase book on the “Deduction of VAT on a decrease in sales value” tab.

How does the regulatory document “Creating entries for the sales book” work?

On the last day of each month, using the “Recovery by Advances” tab is necessary. After this procedure, accounting records are recorded for advances issued and transactions are created. We are talking about restoring the tax on transactions for which an advance was previously issued by the company, and then the advance was returned or the goods arrived. Posts:

D-t 76 VA K-t 68.02

All operations that are not routine should be carried out correctly in the database before the time of 23:59:58, and routine operations should be carried out following the sequence scheme on the last day of the month, at the time of 23:59:59. Then the BU and NU will be reliable, correct and all operations will be taken into account.

How does the resulting s/f work?

- for admission;

Based on transactions for the purchase of goods, a financial account is created.

The VAT entry is performed using the “Receipt of goods or services” operation.

— D-t 19.03 K-t 60.01;

— Dt 19.04 Kt 60.01.

There are two options for creating a s/f entry in the purchase book:

— In the s/f you need to check the box to calculate the VAT deduction;

— In the receipt, check the box for calculating the VAT deduction.

For capitalized goods and materials, you can deduct VAT, according to explanatory letters from the Ministry of Finance, for a three-year period, the calculation begins from the moment this RIGHT arises. After the specified period, the refund cannot be used.

- for the advance payment;

S/f from the supplier for the advance received by him is transferred to the buyer. It serves as the basis for reflecting the document “S/f received” in 1C. It requires checking the “Reflect VAT deduction” checkbox. After this, the following accounting entries are recorded:

D-t 68.02 K-t 76 VA

It is possible to deduct VAT from advances issued, according to explanatory letters from the Ministry of Finance, only in the reporting month, that is, when this RIGHT arose, the deduction cannot be transferred to subsequent reporting periods.

When goods are received, “S/f received” is recorded in the sales book for the amount of the advance issued to the supplier, on the “Recovery for advances” tab.

If goods and materials are received partially and do not fully cover the advance payment, VAT restoration in the 1C program on an advance previously received occurs precisely for the amount of the partial receipt.

The entry related to the restoration of tax from the advance payment is made in the sales ledger. As a result, accounting accounts are created:

D-t 76 VA K-t 68.02

- to increase the cost;

S/f for a change in value towards an increase is drawn up in the same way as for a decrease.

Postings are made when posting the “Receipt Adjustment” document.

D-t 19.03 K-t 60.01

- to reduce the cost.

The “S/f received” document is drawn up using the “Receipt Adjustment” document.

The documents indicate the following:

— In receipt — “Adjustment by agreement of the parties”;

— In s/f – “Adjustment”.

Entries to adjust the cost of received goods are made using the document “Receipt Adjustment”. The following entries appear:

Dt 19.03 Dt 60.01 – reversal

To generate entries in the sales book, you need to check the “Recovery of VAT in the sales book” checkbox in the “Receipt Adjustment” document.

D-t 19.03 K-t 68.02

How does the regulation on “Creating entries for the purchase book” work?

The regulatory document “Creating entries in the purchase book” located in the journal “VAT Regulatory Documents” is needed to automatically fill out the purchase book. It is formed on the basis of documents created and entered into the database, which reflect the fact of receipt of goods.

When creating regulatory operations, it is better to use the “VAT Accounting Assistant”, this will be:

- Just;

- Reliable;

- Clearly.

Tangible changes affected innovations in the 1C: Accounting 8 database, ed. 3.0, a mechanism is prescribed that determines the procedure for maintaining separate accounting of input VAT.

Separate accounting, is this?

In a typical configuration, the taxpayer has to keep separate records of “input VAT” for transactions that are subject to tax:

- Taxable;

- Not taxed.

The taxpayer may not maintain separate accounting, in accordance with paragraph 8 of paragraph 5 of Article 170 of the Tax Code of the Russian Federation, in those tax periods in which the share of total expenses for the production of goods (work, services), property rights, transactions for the sale of which are not subject to taxation, does not exceed 5 percent of the total value of total production costs.

Controlling authorities, as part of an on-site, desk audit, upon discovering a fact where a company is obliged to carry out separate accounting for input VAT, but for some reason does not carry out separate accounting, may refuse to accept a certain share of input tax for deduction.

Separate accounting is also required for export supplies with a 0% VAT rate.

To facilitate separate accounting, the developers added to account 19 a new sub-account “Method of VAT accounting”.

It makes it possible to carry out separate accounting for received transactions:

- Throughout the month, without waiting for the end;

- Transparent;

- It's clear;

- Clearly.

In order not to expose the organization to penalties and interest, it is better to carry out separate accounting in the database.

Every accountant sooner or later encounters advance payments (whether to their suppliers or advances from buyers) and in theory knows that according to the requirements of the Tax Code of the Russian Federation (Article 154, paragraph 1; Article 167, paragraph 1, paragraph 2 ) VAT must be calculated on the advance payment on the date of its receipt. Our article today is about how to do this in practice with advance invoices in the 1C 8.3 program.

Making the initial settings

Let's take a look at the company's accounting policy and check whether the tax regime we have indicated is correct: OSNO. In the “Taxes and Reports” section in the “VAT” tab, the program gives us a choice of several options for registering advance invoices (Fig. 1) (we need this setting when we act as a seller).

We may not register advance invoices in 1C if:

- the advance was credited within five days;

- the advance was credited until the end of the month;

- the advance was credited until the end of the tax period.

It is our right to choose any of them.

Let's analyze the offset of advances issued and advances from the buyer.

Accounting in 1C for advances issued.

For example, let’s take the trading organization Buttercup LLC (we), which entered into an agreement with the wholesale company OPT LLC for the supply of goods. According to the terms of the contract, we pay the supplier an advance of 70%. After which we receive the goods and pay for them completely.

In BP 3.0 we draw up a bank statement “Debit from current account” (Fig. 2).

Please pay attention to important details:

- type of transaction “Payment to supplier”;

- contract (when posting goods, the contract must be identical to the bank statement);

- VAT interest rate;

- offset of the advance payment with VAT automatically (we indicate a different indicator in exceptional cases);

- When posting a document, we must receive correspondence of 51 invoices with the supplier's advance invoice, in our example it is 62.02. Otherwise, an invoice for the advance payment in 1C will not be issued.

Having received payment, OPT LLC issues us an advance invoice, which we must also post in our 1C program (Fig. 3).

On its basis, we have the right to accept the amount of VAT on the advance as a deduction.

Thanks to the “Reflect VAT deduction in the purchase book” checkbox, the invoice automatically goes into the purchase book, and when posting the document, we receive an accounting entry with the formation of invoice 76.VA. Please note that the transaction type code 02 is assigned by the program independently.

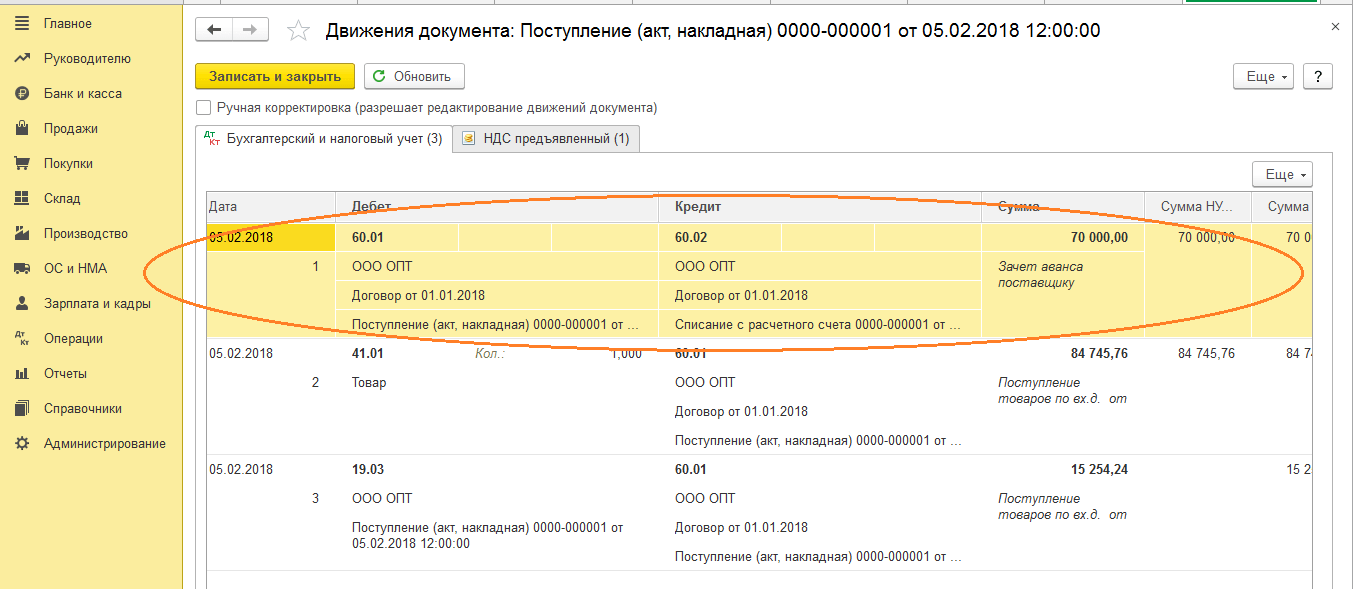

Next month OPT LLC ships the goods to us, we receive them in the program using the document “Receipt of Goods”, and register an invoice. We do not correct accounts for settlements with the counterparty; we select “Automatic” for debt repayment. When posting the “Goods Receipt” document, we must receive a posting for the advance payment offset (Fig. 4).

When filling out the document “Creating sales book entries” for February, we receive automatic completion of the “VAT Restoration” tab (Fig. 5), and this amount of restored VAT ends up in the sales book for the reporting period with transaction code 22.

To reflect the final payment to the supplier, we can copy and post an existing document “Write-off from the current account”, indicating the required amount.

We create a purchase book, which reflects the amount of our VAT deduction on prepayment with code 02, and a sales book, where we see the amount of restored VAT after receiving the goods with transaction type code 21.

Accounting in 1C for advances received

For example, let’s take an organization familiar to us, LLC “Lutik” (we), which entered into an agreement with the company LLC “Atlant” for the provision of goods delivery services. According to the terms of the agreement, the buyer of Atlant LLC pays us an advance of 30%. After which we provide him with the necessary service.

The method of working in the program is the same as in the previous version.

We formalize the receipt of an advance in 1C from the buyer with the document “Receipt to the current account” (Fig. 6), followed by registration of an advance invoice, which gives us accounting entries for calculating VAT on the advance (Fig. 7).

You can register an invoice for an advance payment in 1C directly from the document “Receipt to the current account”, or you can use the processing “Registration of invoices for an advance payment”, which is located in the “Bank and cash desk” section. In any case, it immediately goes into the sales book.

At the time of the document “Sales of services”, the buyer’s advance will be credited (Fig. 8), and when the document “Creating purchase book entries” (Fig. 9) is executed, the amount of VAT on the advance received will be deducted, account 76.AB is closed (Fig. . 10).

To check the fruits of his work, an accountant usually only needs to create books of purchases and sales, as well as analyze the “VAT Accounting Analysis” report.

Work in 1C with pleasure!

If you still have questions about advance invoices in 1C 8.3, feel free to ask us on the dedicated line. They work 7 days a week and will help in the most difficult situations in tax and accounting.

- Why do you dream of jumping in a dream?

- A lot of clothes interpretation of the dream book

- Why do we get sick? teachings of Luule Viilma. Psyche and body. Teachings of Luule Viilma How the doctor explained the occurrence of the disease

- Course work: Problems and prospects for the development of agricultural insurance using the example of Service OJSC

- Physics formulas that are recommended to be learned and mastered to successfully pass the Unified State Exam

- Economic foundations of the theory of break-even of sksit enterprises

- Each of the segments ab and cd

- The fight against corruption in Russia

- Skeletal system Human skeletal system

- Receptors are presented. Educational portal. Receptors and their role in the human body

- Lost my wristwatch in a dream

- Compatibility of Ox and Snake: an enviable idyll in the relationship between a man and a woman

- Certificate of tax residence Documents to confirm the status of a resident of the Russian Federation

- VAT recovery 1s bp 3

- Accounting info Losses of past periods in 1s 8

- Fresh cabbage soup: step-by-step recipe

- How many calories are in apple charlotte?

- Osho Dynamic Meditation

- Special Drawing Rights, SDR

- Drawing lesson "rectangular projection onto three mutually perpendicular projection planes"